- Details

- Published on 12 February 2026

(Credit: David Fleetham / ALAMY Stock Photo)

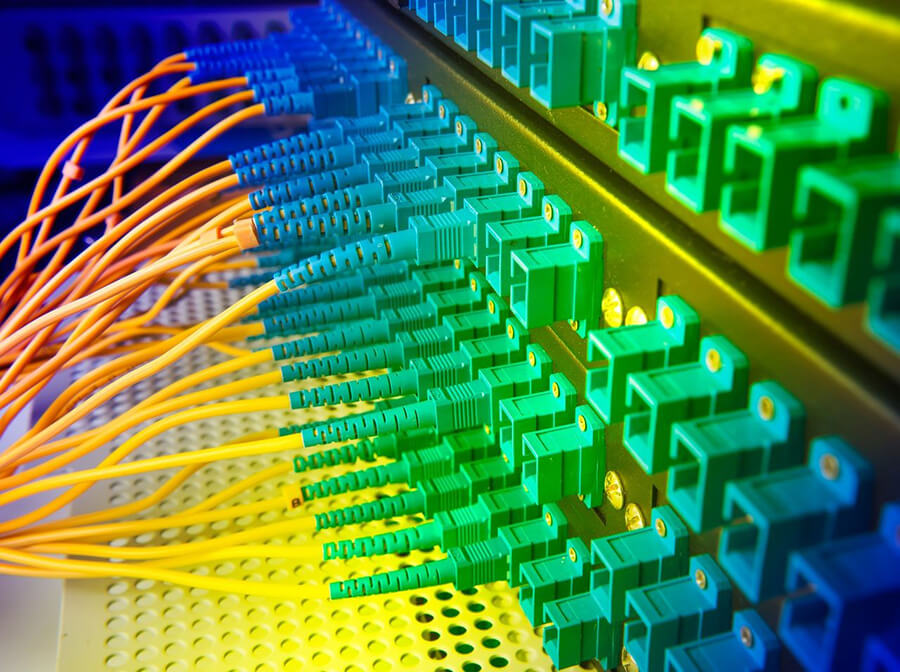

Companies are investing heavily in new subsea cable infrastructure to enhance global connectivity and support their data center operations.

After a year peppered with news about subsea cable cuts, Amazon, Meta and Google are planning new cabling systems for 2025, spending big to boost critical infrastructure for enterprises.

Amazon Ireland filed for a license to land a cable connecting Ireland to the U.S. Meanwhile, Meta is planning an international subsea cable network, and Google expects to expand its already extensive undersea infrastructure.

Amazon’s latest

In January 2025, Roderick Beck broke the news of the Amazon-Ireland cable filing on LinkedIn and his blog. Beck’s Luminous Real Estate and Telecom OU is a brokerage that handles subsea and terrestrial networks. Amazon has not yet confirmed the venture.

According to Beck, Amazon is considering landing the subsea cable near Castlefreke on Ireland’s South Coast in county Cork along a stretch of beach called the Strand.

In addition to connecting two longtime trading partners and allies, Beck said the planned Amazon cable could provide sorely needed physical diversity — at least on the terrestrial side to the Irish Sea and older Atlantic cables, such as Hibernia North and South and AC1.

“I can never emphasize enough how much money Amazon loses if it cannot serve its customers for even just a few seconds,” Beck said in his blog.

Key data centers in Ireland

Ireland is a critical hub for Amazon. The company’s data centers serve not only Ireland but also Europe for retail e-commerce. Beck estimated that Amazon has at least the following data centers in Ireland:

- Seven in operation or planned at Cruiserath Road, Dublin.

- Five in Clonshaugh Business Park, where EXA Infrastructure has its cable landing station.

- Three in Blanchardstown Business Park.

Beck said he believes Amazon’s Ireland-U.S. link will be based on a 12-fiber pair spatial-division multiplexing cable.

What is Google doing?

Google, meantime, is the world’s largest owner and investor in submarine cable networks, according to Submarine Networks. Between 2016 and 2018, Google invested $47 billion to improve its Google Cloud infrastructure to 134 points of presence and 14 subsea cable investments worldwide.

In 2020, Google announced the Grace Hopper subsea cable, linking the U.S., U.K. and Spain. In 2023, it announced the Nuvem transatlantic subsea cable, connecting Portugal, Bermuda and the U.S. Finally, in November 2024, Google introduced its plans for Australia Connect, building on its existing Pacific Connect infrastructure.

Meta plans to join the fray

Meta, the parent of Facebook, Instagram and WhatsApp, is the second biggest driver of internet usage globally. In late November, TechCrunch reported Meta’s plan to build a fiber-optic subsea cable extending around the world. According to TechCrunch, Meta is slated to spend as much as $10 billion to build the 40,000-plus kilometer network.

Higher stakes

The global subsea cable network underpins worldwide communications, carrying 95% of all intercontinental data traffic and an estimated $10 trillion of daily financial transactions.

Recent and suspicious cuts in the Baltic Sea have renewed focus on the precarious condition of existing networks. Repairs are time-consuming, and the specter of rising insurance rates is fueling action from various organizations to find ways to avert and deal with cable cuts. These organizations include the U.N., NATO, the International Telecommunication Union and the International Cable Protection Committee.

For example, NATO introduced Project HEIST to create a system that routes data from underwater cables to satellites during outages and cuts. This plan promises a new approach to avoiding future service disruptions.

In the meantime, the prospect of newer, higher-capacity subsea cables entering the market should benefit enterprises and service providers.

Read more about:

- Details

- Published on 12 February 2026

(Credit: wu kailiang / Alamy Stock Photo)

Spending on data center infrastructure for AI is expected to soar 35 percent to over $400 billion by year-end, according to a recent report. Here is some advice and guidance for enterprises considering deployment.

The allure and potential of AI to enterprises and hyperscalers has captured the imagination of businesses worldwide, but what must they consider to implement it in their data centers? Specifically, they need an infrastructure that meets the compute, networking, and storage requirements of their AI implementations and workloads.

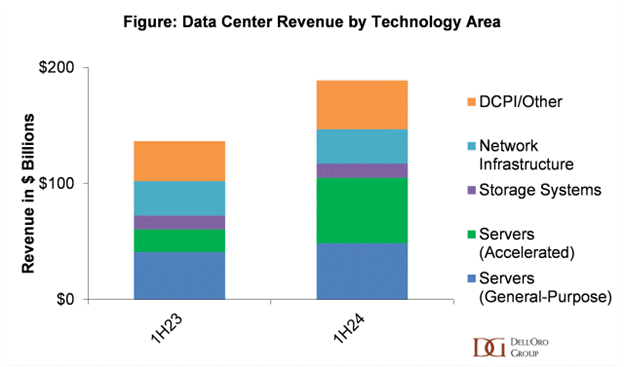

To that end, a look at infrastructure spending shows the impact of AI on enterprises today. Driven largely by sales of AI-powered accelerated servers, global data center purchases surged 38% year over year in the first half of 2024, according to a report covering all aspects of data center equipment spending from the Dell’Oro Group, a market research and analysis firm.

AI Servers and Infrastructure Spending Fuel Future Growth

Looking ahead to the full year 2024, data center CapEx is projected to increase by 35 percent to over $400 billion, with spending on AI servers and infrastructure leading the way, according to the report. Hyperscale cloud service providers are racing to expand their AI offerings, creating a strong demand for these specialized systems.

Related:Top 5 Infrastructure for AI Articles in 2024

“AI infrastructure adoption is still in its initial stages for enterprises, according to Baron Fung, Senior Research Director at Dell’Oro. “Organizations are figuring out how much to invest, as the return on investment (ROI) depends on the scale of AI models they plan to support on-premises and how well they can utilize those models. “

In the short term, he continued, using public cloud services may make more sense while enterprises refine their usage models. “One of the most common questions we encounter is how companies can monetize AI investments and achieve their desired returns.”

Infrastructure Progress Even with The Challenges

Despite these challenges, AI infrastructure deployments are gaining traction, particularly outside of hyperscalers. Server OEMs such as Dell, Supermicro, and HPE, which cater to non-hyperscaler markets, have significantly increased their AI system sales.

Beyond high costs, enterprises must address limitations in power and data center capacity, as AI infrastructure often has different power and cooling needs compared to traditional IT systems, explained Fung.

Organizations investing in AI for private data centers include Tier 2 cloud providers and enterprises in industries such as finance and high-tech manufacturing.

“While some may deploy large AI clusters, most are implementing smaller-scale systems (e.g., a few racks) for tasks like fine-tuning models or inferencing; others are building private AI clouds to ensure sensitive data remains isolated from the broader internet,” explained Fung.

Data Center AI Infrastructure Spending Trends

While the report covered advancements in many types of data center equipment spending, AI/accelerated service CapEx is more important than the rest as it is growing faster, followed by physical infrastructure. Potential customers should realize that all the pieces of the data center need to be deployed in synchronization.

This rapid increase was primarily driven by the rise of accelerated servers, which are critical for generative AI applications. This marks the fourth consecutive quarter of triple-digit year-over-year revenue growth in accelerated server shipments.

Driving Accelerated Computing

AI has performance requirements that are different from those of traditional HPC. As such, hardware accelerators and co-processors for AI are designed to complement a high-performance CPU or other processor for the purpose of accelerating a specific function or workload.

To that point, accelerated computing utilizes specialized hardware like GPUs, ASICs, DPUs, TPUs, and FPGAs to execute computations more efficiently than CPUs, enhancing speed and performance. It is especially beneficial for tasks that can be parallelized, such as high-performance computing, deep learning, ML, and AI.

Server upgrades, particularly to 4th and 5th generation CPU platforms, have been long overdue, and despite ongoing global economic uncertainties, demand for these systems is expected to rise, says the report.

New Data Center Physical Infrastructure (DCPI)

The data center physical infrastructure (DCPI) market outperformed expectations in the first half of this year. Growth was attributed to new data center construction with AI-related design modifications to support increasing rack power densities, according to the report. North America led the way with the fastest growth rate, while revenues in the Asia-Pacific region, excluding China, also saw double-digit growth.

Server and storage system component revenues reached record highs in the first two quarters of the year. The rapid growth of accelerators, which include GPUs and custom accelerators, as well as memory and storage drives, was a key factor behind this revenue increase. “Generative AI applications were the primary drivers of accelerated server demand, but higher commodity prices, particularly for memory and storage drives, also contributed to the revenue surge, explained Fung.

With respect to component revenues, the report forecasted them to double in 2024, fueled by the increased deployment of specialized processors such as accelerators and SmartNICs. Commodity component prices, such as memory and storage drives, are expected to rise throughout the year.

Another element of data center infrastructure that needs to be updated for AI is Ethernet switches. It might be several more quarters for this segment to grow due to inventory issues. “We project the recovery in the Ethernet switch market to be led by the hyperscale cloud SPs on both networks for general-purpose computing and AI clusters,” said Fung.

The Road Ahead on Infrastructure for AI Data Center Directions

AI impacts far more than data center operations of users and service providers operations, especially in the area of network management. And since it’s a fast-evolving area, learning more about AI is solid advice. Is your infrastructure ready?

- Details

- Published on 12 February 2026

(Credit: Kim Christensen / Alamy Stock Photo)

Copper thieves cost U.S. businesses $1 billion a year and are a threat to critical infrastructure. What can you do to prevent putting resiliency at risk?

Just when IT managers thought they had accounted for and addressed all possible threats to the health and well-being of their network sites, an unforeseen challenge has emerged. That is the rise in cooper thieves who turn copper lines into gold.

The cash-for-copper phenomenon is not new, but it has evolved into a nationwide problem, resulting in knocked-out lights, interrupted traffic, downed countless websites, and transportation nightmares.

In some cases, crimes are committed by drug addicts looking to get some quick cash. In other cases, crimes are committed by organized groups or opportunistic thieves, such as employees of businesses that work with metal.

Ohio ranks first among the top five states with the most insurance claims for metal thefts, followed by Texas, Georgia, California, and North Carolina. Utilities will pass increased insurance costs to businesses and consumers.

The U.S. Department of Energy has estimated that metal theft costs U.S. businesses around $1 billion a year. From January 1, 2010, through December 31, 2012, NICB analysts identified 33,775 insurance claims for the theft of copper, bronze, brass, or aluminum—32,568 of them (96 percent) for copper alone. This shows a 36 percent increase in claims when compared with the 25,083 claims reported between January 1, 2009, and December 31, 2011.

Cash for copper thieves have expanded their mainstay powerline targets to include harvesting the metal from ground and roof-mounted HVAC units and systems, raising concerns among telecom service providers that disrupting cooling could cause challenges to switching systems, data centers, and POPs without adequate backup systems. Most communications service providers offer service-level agreements (SLA) under which businesses are promised a certain amount of uptime and a mean-time to repair problems, which, if unmet, can result in financial compensation or cancellation of the contract.

How Copper Thieves Disrupt Critical Infrastructure

The FBI reports that electrical substations, cell towers, telephone landlines, railroads, construction sites, and vacant homes are all targets. This can disrupt electricity, telecommunications, transportation, water supply, heating, security, and emergency systems.

Network service resiliency at risk. Examples of the scope of the disruptions abound, including:

- Washington State: Copper thefts near Seattle-Tacoma International Airport disabled the approach lighting for one of the airport’s runways. Thieves are also stealing copper-based EV charging cords. Lumen, a global communications service provider, has already shelled out $500,000 due to copper thefts in 2024 in Washington alone.

- California: In late August, 82 suspects were arrested after tens of thousands of pounds of copper were recovered as part of a crackdown by Los Angeles police and staff on thieves.

- Mississippi: Five tornado warning sirens didn’t alert residents of impending storms because their copper wires had been stolen, according to a blog by Ooma.

- Texas: Metal thieves stole over $10,000 of copper from the Garland, Texas, area before being pursued and arrested by police.

- Virginia: After a spike of copper thefts from copper-carrying trucks traveling along Virginia highways, state authorities in Virginia, working with National Insurance Crime Bureau (NICB) special agents, arrested a man at the center of the thefts.

- A spike in copper cable thefts in recent months has left AT&T customers in South Dallas, Texas, without phone and internet service on more than a few occasions.

(Credit: FPI / Alamy Stock Photo)

Telcos React to Cooper Thieves

AT&T is collaborating with local officials and the police in the Dallas area. The company offered residents a $10,000 reward for information leading to an arrest and conviction in connection with copper cable thefts. Smaller carriers in less densely populated areas, such as Kinetic, have also offered a $10,000 reward.

Although notifying law enforcement and your service provider(s) when hit by a loss of power to parts of your business seems like a normal reaction, IT managers may want to consider problem prevention. Beset by copper for cash attacks, an industry coalition put together a list of tips to thwart these metal thieves. It is summed up below.

To prevent copper thieves from carrying out their mischief, consider taking the following steps:

- Develop a security plan for your business that identifies vulnerabilities. Ask your local law enforcement professionals to assist you with this process.

- Deny access by adding fences and gates to contain this private property. Ask your local law enforcement for help in enforcing the law on private property.

- Add security lighting to areas where thieves and other criminals may hide.

- Deny access to your roof-mounted HVAC units by removing fixed ladders (do not remove fire escapes) and other step-ups, including tree branches.

- Consider the use of steel cages to enclose your AC units. The heavier the gauge of steel, the longer it will take to cut. For example, 10–12-gauge steel can take one to two hours to cut. Avoid standard chain link fencing as it can be cut quickly.

- Use security cameras, but they must be properly protected, installed, and monitored.

- Use alarms mounted to your HVAC units. If the unit is tampered with, including cutting of refrigerant and power lines, an alarm will sound.

A Final Word on Copper Thieves and Net Resiliency

Although law enforcement entities are cracking down on copper thefts, it remains a growing problem across the nation. Hopefully, with enhanced awareness and preventative measures, organizations can sidestep business interruption.