Articles

Sample Articles from Bob Wallace.

Read More about Bob.

The DISH-SpaceX 5G Spectrum Dispute; Enterprise Impact and Possible Outcomes

- Details

- Published on 26 July 2022

(Source: Pixabay)

If the FCC rules interference is a concern, spectrum sharing systems could provide a solution for all parties by maximizing the use of the 12GHz band.

In the latest spectrum challenge, Elon Musk's SpaceX claims DISH Networks wants to use the 12 GHz band with its terrestrial 5G network, which would cause harmful interference to his emerging Starlink satellite Internet service. DISH disagrees.

For its part, DISH already has a 5G network and hopes to expand it by moving into the 12 GHz band, which it uses to provide satellite TV service.

In January, the FCC voted to issue a Notice of Proposed Rulemaking (NPRM) seeking comment on ways the 12 GHz band might be better used. The notice sought input on methods for allowing new uses in the band while protecting incumbents.

Both operators have submitted to the FCC technical studies that support their arguments regarding interference. SpaceX’s Musk has successfully urged customers to contact the agency supporting the company’s claim.

DISH continues to claim a 12GHz 5G network can coexist with satellite internet services without generating interference.

Both operators, and much of the telecom industry, await a ruling from the FCC, which has not said when it will act.

Enterprise IT impact

Enterprise IT, however, may not feel a significant impact from the resolution of the challenge. That is unless they seek broader competition in the private 5G wireless network sector or are looking to connect mostly rural sites using Low Earth Orbit (LEO) satellite services.

The broader impact could reach farther if the FCC finds no inference and/or recommends a spectrum sharing approach that could maximize the use of the 12GHz band by all interested parties without fear of interruption.

This appears to have worked well with the Citizens' Broadband Radio Service (CBRS) creation, auction, and diverse spectrum winning bidders, including many enterprises, most looking to build private 5G networks.

Building a spectrum-sharing infrastructure will take time, and that is once the FCC rules on the 12GHz band dispute.

A recent history of 5G service interference concerns

For veteran IT staff, this is but the very latest in a lengthy list of disputes over potential interference caused by shared use of the same spectrum. Most recently was last year’s spike in concern about 5G services offered in the C-band near U.S. airports interfering with altimeters, which are used to gauge elevation in airplanes.

The concerned parties expressing serious concern about harmful interference included the Federal Aviation Administration, CEOs of several airlines, the Department of Transportation, and plane makers. AT&T and Verizon were in opposition to slowing the deployment of 5G near airports. But the carriers eventually agreed in January to delay rollouts by six months while the key players explored the issue.

In June, the FAA announced that key stakeholders in the aviation and wireless industries have identified a series of steps that will continue to protect commercial air travel from disruption by 5G C-band interference while also enabling Verizon and AT&T to enhance service around certain airports.

- The phased approach requires operators of regional aircraft with radio altimeters most susceptible to interference to retrofit them with radio frequency filters by the end of 2022. This work has already begun and will continue on an expedited basis, according to the agency.

- At the same time, the FAA said it worked with the wireless companies to identify airports around which their service can be enhanced with the least risk of disrupting flight schedules.

During initial negotiations in January, the wireless companies offered to keep mitigations in place until July 5, 2022, while they worked with the FAA to better understand the effects of 5G C-band signals on sensitive aviation instruments.

Based on progress achieved during a series of stakeholder roundtable meetings, the wireless companies offered Friday to continue with some level of voluntary mitigations for another year, according to the FAA.

Despite the collaborative efforts to work out a solution, a permanent fix has not yet been created and agreed on.

The CBRS sharing solution

If the FCC and its tech experts are concerned about interference between DISH 5G and SpaceX birds, the situation could be addressed so that neither is shut out of the 12 GHz band. That could be enabled using spectrum sharing, which was used to let carriers, enterprises, and others to concurrently use the 3.5 to 3.7 GHz space alongside longtime users. The 2020 auction made available space to 228 winning bidders and brought the FCC $4.58 billion.

DISH, bidding under the name Wetterhorn Wireless, came in as the second largest total winning bidder, spending over $900 million.

A wireless industry ecosystem, including the FCC, equipment vendors, and those building systems necessary to enable greater spectrum sharing, have been hard at work to prepare the CBRS for a wave of new users. The band is valued at over $15 billion.

The initial commercial deployment of CBRS service was approved by Spectrum Access System (SAS) administrators Amdocs, CommScope, Federated Wireless, Google, and Sony.

Telecom Industry Takes the Workforce Challenge to Staff Internet-for-All Broadband Rollout

- Details

- Published on 30 June 2022

(Source: Pixabay)

Demand for skilled staff is sky high, but not supply, for the largest-ever U.S. infrastructure effort. Associations, carriers, and vendors look to fill the staffing gap as spending on fiber broadband climbs.

With supply chain challenges aplenty in expanding broadband networks, carriers are now facing a workforce shortage in deploying the fiber equipment that they have purchased, especially for the Fed-funded Internet-for-all program.

For those IT managers that were not yet aware of the workforce shortage, which could complicate network expansion plans, Charter Communications CEO Tom Rutledge sounded the alarm last month at a Moffett Nathanson investor conference.

“There is no labor pool there. For all the construction that must be done, there is no skilled labor force that is currently out there doing it that can be repurposed,” warned Rutledge. “It has to be built and trained.”

“It's going to be challenging,” he continued. “We have thousands of unfilled positions.” Charter serves over thirty-two million business and residential customers in forty-one states.

Why now? How did we get here?

The deluge of broadband funding, along with private expansion efforts, is driving a major spike in demand for those services and for workers. Many have begun to land large grants, with some launching their own training and certification programs which offer a big boost in open jobs in local communities and far beyond.

Telecom industry responds to the needs

Despite the doom-and-gloom outlooks borne out of supply chain breakdowns, planning, and component shortages, the networking industry has begun fighting back, with an ambitious fledgling training and certification program from the Fiber Broadband Association (FBA) in Wilson, North Carolina, and a vastly expanded undertaking by partners AT&T and fiber manufacturer Corning. Do not forget training programs created by individual communities.

Just how broad is the shortage of tech workers needed to help carriers deploy broadband infrastructure funded by the Biden Administration's Infrastructure and Jobs Act? Consider this:

Carriers have come from far-flung locations to poach students from a nascent fiber broadband certification program launched as a pilot in early March to educate and train attendees – from the FBA in conjunction with Greenlight Community Broadband at Wilson Community College in Wilson, N.C.

The FBA has been engaged with twenty-three states about rolling out this fiber optic technician training program with their community college systems and fiber optic broadband service providers. “We look to reach all 50 states and the U.S. territories by the end of the year," said Deborah Kish, Vice President of Research and Workforce Development at the FBA, when the undertaking was launched.

With equal parts classroom and hands-on instruction, the Optical Telecom Installation Certification (OpTIC) program was designed by fiber broadband experts to quickly scale fiber technician education, fill the existing fiber skills gap, and accelerate fiber deployments across North America.

The need for skilled fiber optic technicians will significantly impact each state’s ability to deploy broadband. The FBA’s OpTIC program teaches the knowledge and skills required to professionally install, test, and maintain high-speed fiber broadband networks.

"When we saw the need for an expanded fiber workforce in order to keep up with broadband demand and growth opportunities, we began development of this intensive training program to ensure that no state is left behind in the digital equity gap," said Kish.

Not singing the Blues in rural Louisiana

LUS Fiber, a city-owned telecom in The Bayou state, was awarded $21 million of a federal grant earlier this year and is asking for a $19 million helping of the state’s $180 million program to expand in other rural Acadiana communities.

LUS is working with South Louisiana Community College (SLCC) to launch a new fiber-optic install technician program this summer to meet the expanding workforce needs of the region and help residents develop skills to launch their careers.

"We've been working with the industry now for just a little over two years to design a program that is versatile enough to produce entry-level employees into each aspect of this industry," SLCC's Director of Transportation, Distribution, & Logistics Charlotte LeLeux told the Lafayette Advertiser newspaper in June.

The school's new fiber-optic technician program, an 18–20-week course, is expected to launch at SLCC’s Crowley campus in July.

It will cover how to splice fiber optic cables, how to hang cable on telephone poles, how to operate installation equipment, and other skills. The goal will be to cover everything from construction to putting fiber in the home, LeLeux said, “so that when they're hired on by these companies, their training with them would be very minimal.”

AT&T, Corning train technicians and network specialists

Targeting workforce development, AT&T and Corning have joined forces to create a new training program focused on equipping thousands of technicians and network specialists across the industry with the skills crucial to design, engineer, install, and manage a growing fiber broadband network across the U.S.

Steve Mitchell, senior vice president, Carrier Networks at Corning Optical Communications, told me: "As the industry is currently experiencing a shortage of technicians and installers, this training will support future needs and help build the skilled workforce of tomorrow,” wrote Jeff Luong, President Broadband Access, and Adoption Initiatives at AT&T in a blog on the undertaking.

"Highly trained workers are needed and needed quickly," emphasized Luong. He predicted the program will be available in time to support the historic government investments outlined in the Biden administration's Infrastructure Investment and Jobs Act.

What’s in the program?

The Fiber Optic Training Program was launched in May and will is taught by experts across the industry, housed in Corning facilities in North Carolina, and serve needs across the country, according to the duo.

“The program includes training on optical fiber and networking, network design, hands-on splicing, connectorization, field construction for cable deployment, testing, and system turn-up,” explained Luong.

The training program will also include network system lab visits and technician ride-alongs. Upon completion, trainees will be ready to fill needed roles at carriers, construction firms, and broadband providers.

The road ahead

Success with staffing will determine if carriers meet their already stated deployment deadlines.

“Collaborating with Corning, the largest manufacturer of fiber optic cable in the U.S., will help AT&T get closer to attaining our goal of reaching 30 million locations with fiber by 2025,” said Luong in the blog post.

Related articles:

Putting Broadband Internet on the Map

- Details

- Published on 13 June 2022

(Source: Pixabay)

With over $40 billion in funding hanging in the balance, accurate new maps are the key to achieving the goal of Internet for all by directing deployments under the Biden Administration’s broadband infrastructure investment act.

In the whirlwind of activity that is the broadband networking industry in the U.S., the most overlooked area is mapping.

Infrastructure funding figures steal the headlines, but in the drive to close the digital divide, IT managers, service providers, and states first need accurate maps that show areas that are underserved or unserved.

The goal of the broadband portion of Biden's "internet for all" aspect of the over $1 trillion Infrastructure Investment and Jobs act passed in November 2021 is to have states lay out a five-year timeline to provide full internet access while ensuring affordable internet access and promoting competition among providers.

Reality bites

For this crucial goal to be completed, current and past maps that many agree were fraught with inaccuracies will need to be replaced with one based on the latest and verified data. Past maps were based on ISP self-reported data that resulted in the overstatement of those with access to broadband Internet in.

The FCC itself has publicly admitted its current broadband maps are flawed. The agency appears to overstate coverage in every state, with an average 21% false-positive rate across the U.S.

Enterprise impact

Accurate broadband mapping is crucial to the rollout and use of high-speed Internet by corporate America and far beyond.

“For enterprise IT managers, accurate mapping is critical just as it is for the states in which those IT managers have facilities,” explained Jeff Heynen, Vice President, Broadband Access and Home Networking for the Dell’Oro Group, a market research and analysis firm. “If maps are not accurate and are potentially inflating the service capabilities and reach of broadband networks in communities that are underserved, then enterprises are going to suffer with lower-speed offerings and limited provider options. And those situations are then unlikely to be improved through state and federal subsidization.”

Why maps matter

For states and other recipients of funding for broadband expansion to spend this money most effectively, they need an accurate understanding of what areas are truly “unserved” with broadband access. It relies on self-reported data from providers and measures broadband availability by census block. If even a single address in a census block has access to broadband, the entire block is considered served. This is a particular problem in rural areas, which have large census block areas.

Updated timeline for new maps and spending plans

Current FCC Chair Jessica Rosenworcel pledged in late March that states, local areas, and other broadband stakeholders will not have to wait until 2023 to see new broadband maps from the agency. She has promised to share new broadband maps with the industry this fall, seeking input before completion. Governors and other leaders would then have six months to use data from the new maps to fuel their final applications detailing their proposed uses.

In mid-May, Secretary of Commerce Gina Raimondo opened applications for $45 billion in federal broadband subsidies.

Per the infrastructure bill passed last year by the Biden Administration, high-speed infrastructure to unserved (25/3 Mbps) and underserved as those without 100/20 Mbps service. The NTIA added that sites served exclusively by satellite or service based on unlicensed spectrum will be considered unserved. States must submit a request for that support either with their letter of intent or by August 15. Those who receive planning funds must submit a five-year action plan within 270 days of getting the money.

The actual outlay for broadband deployment specifies a minimum distribution of $100 million per state or other qualifying area. Though it is expected total payouts will be in the $800 million neighborhood.

Broadband haves and have-nots

Last year, BroadbandNow Research manually checked the availability of terrestrial broadband internet (wired or fixed wireless) for more than 58,000 addresses. "In all, we checked more than 110,000 address-provider combinations using the FCC Form 477 data as the "source of truth."

The firm found that forty-two million Americans do not have the ability to purchase broadband internet in 2021, according to the firm. “This is an additional 6.5 percent of Americans beyond FCC estimates.”

Fixing the maps problem

Aware of the growing problem presented, Congress stepped in in March 2020 passed the Broadband DATA Act to help fix this problem.

The act requires the FCC to create maps showing the availability of fixed and mobile broadband service across the country and identify areas that are unserved and underserved. It also requires the FCC to use more granular and precise data to develop these maps.

The map must be posted online so people can search by address, provider, state, type of service, and other factors to see coverage in their area or across the country. Congress provided the FCC with $98 million to complete that effort.

Broadband Task Force created

One year later, in February 2021, the FCC took additional action and created the Broadband Data Task Force. In doing so, the agency admitted “the need to implement long-overdue improvements to the agency’s broadband data and mapping tools.”

The Task Force will closely coordinate the Commission’s broadband mapping and data collection efforts across the various expert agency teams. Each of these teams is essential to the effort of ensuring the Commission, other Federal agencies, state and local governments, Tribal entities, and consumers will have access to granular nationwide information on the availability and quality of broadband services.

At the state level, county, and city

In anticipation of the mapping and funding process, states have created their own broadband task forces charged with reviewing and evaluating carrier plans before awarding funding for providing broadband to un- and underserved areas.

But it does not stop there at the state level, as individual cities, as well as counties in some regions of the country, have also been created. The National Association of Counties (NACO) has created a Broadband Task Force, comprised of nearly three dozen county government officials from across America, which "will study the lack of reliable broadband with a particular focus on the challenges facing underserved communities."

Related articles:

- What Enterprises Can Expect as Carriers to Spend Billions on Broadband Rollouts

- Answering Broadband Questions in the Infrastructure Investment Bill

Will U.S. Businesses Leverage 5G in Canada?

- Details

- Published on 25 May 2022

(Source: Pixabay)

Expansion-minded U.S. enterprises, and those hurt by weak supply chain links, can find 5G-driven alternatives closer to home.

Hamstrung by Covid-disrupted supply chains, some U.S. businesses are looking to shorten and localize the systems. The answer for IT managers could be north of the border, where our second-largest trade partner Canada is also using 5G to create a digital economy.

But although the top 5 Canadian carriers are working to deploy 5G networks, they lag their counterparts here in the U.S., which can present challenges for enterprises looking to expand and enhance operations in Canada.

Know your neighbor

Be aware that Canada is all in on 5G and understands what it can do for the nation’s economy, with 5G networks estimated by GSMA Intelligence to deliver approximately $150 billion in additional value add to the country's economy from 2020 to 2040. The technology will play a crucial role in driving economic growth and supporting the recovery from the impact of Covid-19.

A makeover is in the works as 5G, with its faster connections (up to twenty times the speeds of 4G), increased network capacity (up to one hundred times the traffic capacity of 4G), and ultra-low latency alone portend to next-level Canada's top industries.

- Agriculture

- Energy

- Mining

- Automotive

- Banking

Top three exported goods pre-Covid:

- Energy products (worth $114 billion)

- Motor vehicles and motor vehicle parts ($93 billion)

- Consumer goods ($71 billion) – Source: Canadian Encyclopedia.

Know the lay of the land

The country’s geography features several large cities close to the U.S. border. The collective mass of the ten provinces and three northern territories is largely rural areas. Canada’s population, 38 million in 2020, is less than that of California.

Deployment costs: As stated by PWC Canada, the country’s smaller telecom industry prevents it from benefitting from the economies of scale enjoyed by carriers in the states. This could mean pricier network equipment and consumer devices.

Carrier competition/regulatory returns: With five key carriers deploying 5G in Canada, U.S. enterprise IT managers have greater choices for now. However, Rogers is working to acquire Shaw for $26 billion this year. Will more acquisitions follow as competition heightens?

Also of note is the fact that competition among these carriers is fierce whether providers are pressing regulators – the Canadian Radio-television and Telecommunications Commission (CRTC) - to block acquisitions and spending on spectrum purchases. This could slow deployments should the regulatory process get bogged down in disputes between the carriers. The CRTC greenlit the pending Rogers buyup of smaller Shaw earlier this year.

However, Canada's commissioner of competition intends to oppose Rogers’ proposed deal with Shaw, the companies said in a statement released in early May.

Regional vs. national: Canada is currently home to both, with Bell Canada providing country-wide service while smaller SaskTel focuses on its province (Saskatchewan). Concurrently, regional carrier Videotron (Quebec) recently spent $830 million on wireless spectrum it hopes to use to provide services across the country.

Private 5G networks

With the deployment of 5G in Canada about 18 months behind that of the U.S., businesses seeking to add sites north of the border could consider extending private 5G networks to these not yet served and remote locations, according to John Simcoe, Telecom, and Media Leader for PwC Canada. In areas that Canadian carriers plan to reach with 5G service, adding sites could be done using cross-carrier exchange agreements with U.S. carriers.

With one of three 5G spectrum auctions in Canada not yet completed, IT managers need to check to see that their networks /services in the U.S. use the same radio frequencies bands as those of Canadian carriers and private network providers, advises Simcoe.

Reaching rural sites: In the U.S., a combined $80 billion-plus has been approved for broadband deployment to close the digital divide (Rural Development Opportunity Funding), and the infrastructure and jobs bill from the Biden administration in the last year.

The investment in Canada started earlier but is far smaller. This could mean reaching unserved and underserved locations will be more expensive and take longer, and could present a losing proposition for service providers.

However, if the rural and remote locations happen to host businesses from top industries such as mining, oil, and transportation, it is a safe bet that these Canadian economic engines will be served early and completely by 5G services, emphasized PwC Canada’s Simcoe.

Canada started earlier, in 2016, on sizable infrastructure investments. It launched The Rural and northern stream of the Investing in Canada Infrastructure Program. The effort earmarked $2 billion over 10 years for priorities in small, rural, and remote communities spanning roads, broadband Internet connectivity, renewable energy, and facilities that support food security.

Canada added the Connect to Innovate: Rural and Remote Broadband effort to provide $500 million over five years, delivered by the Innovation, Science and Economic Development Canada program to extend and enhance broadband service in rural and remote communities. The funds were to bring high-speed Internet to 300 rural and remote communities.

Performance innovation – Standalone 5G nets

Rogers revealed in March that it has teamed with Ericsson to launch one of the first commercial 5G Standalone Networks (SA). The new service was activated after completing the rollout of Canada’s first national standalone 5G core.

With 5G core and 5G Radio Access Network (RAN) slicing, Rogers claims it can deliver new services to customers, such as dedicated private networks, public safety applications, and access to edge computing.

The carrier said that it has completed its 5G standalone core network deployment nationally and is deploying its 5G standalone service coverage in Montreal, Ottawa, Toronto, and Vancouver.

The SA difference

Simply stated, NSA makes it easier for network operators to deploy a 5G network as it can reuse current 4G facilities.

An important example of the difference between a 5G SA network and a 5G NSA system is that the former allows wireless customers with capable devices to connect to the 5G SA network. Such customers will automatically connect to the 5G SA service where it is available. The benefits are higher speeds and lower latency.

In contrast, 5G NSA mode networks rely on the 4G network facilities to provide more speed and higher data bandwidth. A 5G-enabled smartphone will connect to a 5G or 4G network, depending on conditions.

Device availability and certification

Because 5G deployment in Canada is proceeding at a slower pace than in the U.S., the list of available user devices is shorter. The good news is that Rogers has established a device certification program. Expect other carriers to follow suit as their 5G networks expand.

But with fewer vendors part of Canada’s telecom industry, U.S. IT managers might find a shorter list of supported devices for their use and workers’ use north of the border.

Rethinking trade and infrastructure

After two years of Covid-driven dysfunction and breakdowns in once-preferred global supply chains, rapid 5G deployments by close-by countries could receive greater consideration as IT managers evaluate adjustments and alternatives.

Canadian Carriers Chase the Digital Economy with Buyouts and 5G Investments

- Details

- Published on 24 May 2022

(Source: Pixabay)

These developments can help U.S.-based enterprise IT understand the business and technology of bringing 5G to offices and homes in Canada.

Canadian service providers Rogers, TELUS, Bell Canada, Videotron, and SaskTel, are rapidly deploying 5G networks to serve consumers and enterprises in a country with cities and vast rural expanses.

This may sound promising to IT managers at U.S. enterprises looking to establish or expand operations north of the border. But what must they consider in evaluating this opportunity?

Tough(er) sledding

Deploying 5G in Canada is far tougher than it is here in the U.S. And delayed 5G deployments threaten Canada’s global competitiveness. That is according to a report from PWC Canada.

The country's role has continued to grow since the North American Free Trade Agreement (NAFTA), signed into law in 1994, eliminated most tariffs between the trio of America, Canada, and Mexico and created a cross-continental trade bloc.

It is no surprise that the U.S. has become the largest goods importer in the world. U.S. goods imports from the world totaled $2.5 trillion in 2019 (pre-COVID 19), according to the Office of the United States Trade Representative. Canada, Mexico, and China are America’s three largest trading partners.

U.S.-based corporations such as automakers have moved the creation and assembly of products (and sourcing) north and south of America’s border to reduce labor and other costs.

PWC: Canada playing catch-up as size matters

In the digital economy, Canadian mobile network operators (MNOs) are negligible compared to their global peers and large multinational competitors, according to PWC Canada.

The three largest Canadian telcos generated, on average, approximately three and a half times less revenue than the leading telcos in the G7, South Korea and Australia. “Similarly, Canadian telcos are undersized compared to some of their main suppliers - significantly hampering their ability to negotiate better prices,” according to the global research firm’s report.

PWC Canada concludes that with the cost of delivering 5G forecast to be up to 71% higher than previous generations of connectivity, “the comparatively small scale of Canadian MNOs and their relatively higher network capital costs are likely to impact investments in the 5G connectivity required to enable the digital economy.”

Resulting acquisitions and big-ticket investments

Rogers acquires Shaw, accelerates 5G rollout

Plans to deploy 5G throughout multiple Canadian provinces came into focus in March as Rogers Communications announced and detailed plans to acquire rival Shaw Communications in a $26 billion transaction designed to accelerate the introduction of 5G in the country. The acquisition, which is expected to close in the first half of this year, will create the country's second-largest cellular and cable operator.

Western Canada is the target region for the introduction of the highest-speed wireless technology.

As part of the landmark acquisition, Rogers claimed it will invest $6.5 billion in Western Canada to build 5G networks, connect underserved rural areas and bring added choices to consumers and businesses. The innovative technology and network investments will create 3,000 net new jobs across Alberta, British Columbia, Manitoba, and Saskatchewan, Rogers added.

The deal has already received the necessary regulatory approval from the Canadian Radio-television and Telecommunications Commission (CRTC).

TELUS shows us

In addition to rolling out 5G in Canada, carrier TELUS is focusing on closing a digital divide in rural areas, which are more prevalent than in the U.S. For that tall task, the provider is employing fixed wireless access (FWA), which has taken something of a back seat to fiber in the U.S, to provide up to 100Mbit/sec Internet access to homes to power productivity.

In the U.S and far beyond, FWA is a quick-to-deploy and cheaper means than fiber to deliver broadband to remote offices and homes. TELUS provides its Smart Hub indoor CPE to complete the coveted high-speed connection over distances to un- and underserved areas.

TELUS has also spent heavily on fiber networking, investing $54 billion to connect 137 communities across B.C., Alberta, and parts of Quebec to its fast-expanding fiber-optic network.

In March, TELUS revealed a plan to bring broadband services to sixty communities spread across British Columbia and Alberta by yearend.

Bell Canada

Bell claimed it achieved its objective to offer 5G coverage for more than 70% of the Canadian population by the end of 2021. That included December turnups of Prince Edward Island with service in Charlottetown, Abram Village, Kensington, and Sherbrooke.

In early February, the carrier announced that 5G is now available in forty-two more communities in Ontario, Quebec, and Nova Scotia.

Videotron’s expansion plans

Videotron, a subsidiary of Quebecor Media, provides wired, wireless, and content services to businesses and consumers in Quebec. It has already rolled out 5G in Montreal and Quebec City.

The carrier is looking to offer services far beyond the boundaries of the province, having spent nearly $830 million in a wireless spectrum auction last July. The investment brought in 294 blocks of spectrum in the 3500 MHz band across the country.

More than half of the investment is concentrated in four Canadian provinces outside Quebec: southern and eastern Ontario, Manitoba, Alberta, and British Columbia. “The strategic investment positions Québec’s flagship carrier to realize its ambition of boosting healthy competition in telecom beyond the borders of Québec,” according to a press release.

Do not forget SaskTel

SaskTel provides wired and wireless services in the Canadian province of Saskatchewan. The carrier said it has been investing $95.9 million into wireless network enhancements, including $55 million on the initial rollout of 5G, in 2021-2022.

SaskTel says 5G is currently available in select locations. By the end of this year, 5G will cover approximately 50% of Saskatchewan's population, according to the company’s website.

Top Considerations for Enterprise Use of Fixed Wireless Access

- Details

- Published on 02 May 2022

(Source: Pixabay)

Carriers’ broadband deployment plans focus on fiber. But a growing number are also using FWA as well. What do IT managers need to know about the alternative to fiber as carrier decisions factor in your network expansion and enhancement plans?

Carriers’ broadband deployment plans focus on fiber. But a growing number are also using FWA as well. What do IT managers need to know about the alternative to fiber as carrier decisions factor in your network expansion and enhancement plans?

Why? While fiber can provide higher speeds, FWA is quicker to deploy, more reliable, and a cheaper means to provide high-speed Internet access in areas that lack broadband. In these scenarios, carriers cannot ROI-justify the time and cost of laying fiber or running it across phone poles to remote areas.

FWA is an increasingly attractive alternative to wired broadband Internet options at a time when carriers are looking to match the media with the population to ensure the service takes rates in their areas are sufficient to provide a profit and avoid a fiber bubble from overbuilding.

Broadband funding

The combined funding pool, which is approaching $100 billion, is fed by the FCC's Rural Digital Opportunity Fund (RDOF) and President Biden's $1.2 trillion Infrastructure Investment and Jobs Act (ARPA), which looks to bankroll the expansion of broadband throughout the nation.

Top considerations for IT managers

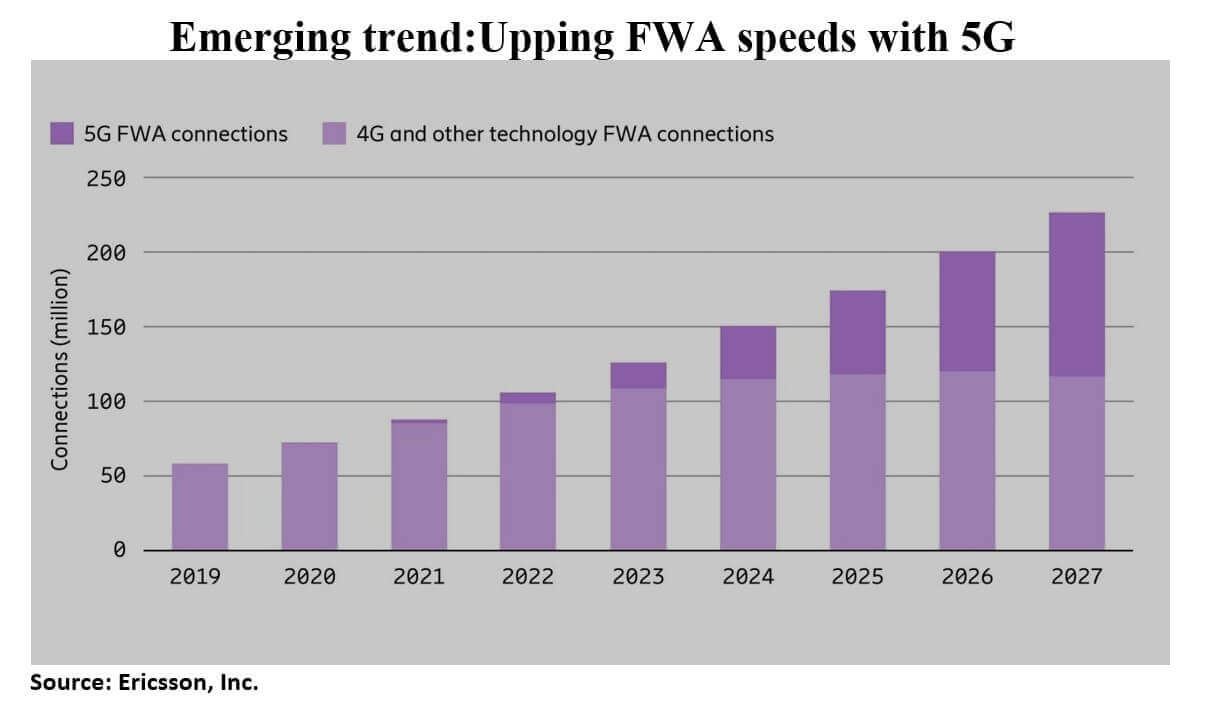

A sunny forecast. The economics and data rate performance of FWA are finally becoming competitive with that of wired internet services, according to Deloitte Global. The company predicts that the number of FWA connections will grow from about sixty million in 2020 to 88 million this year, with 5G FWA representing almost 7% of the total. “While our analysis reveals a 19% 2020–2026 CAGR in total FWA connections, 5G FWA connections will grow even faster, at a CAGR of almost 88%, over the same period,” wrote the authors of the Deloitte Insights report.

Deployment. If you are looking to quickly extend your corporate network to new locations such as small branch offices and remote workers in un or underserved areas such as rural regions, FWA is the answer since the radio frequency-based systems do not require digging, and the process carriers must go through for builds in municipalities. And do not forget winter weather in much of the U.S. as an impediment to digs for fiber.

FWA systems (typically point-to-multipoint) are above ground and can use different radio frequencies to deliver service to special CPE at the business or residence in an expedited manner.

Availability. With fiber, businesses risk service interruptions from cable cuts and damage from storms and car accidents to phone poles atop which the cables are often strung to speed rollouts, especially in rural areas. With carriers looking to use both media, compare SLAs for availability and other essential metrics such as mean time to repair.

Performance. In many cases, fiber systems can be upgraded to support higher speeds than FWA. But that does not mean the wireless option is not sufficient for the needs of potential network locations and WFH residences. FWA systems can support a wide range of speeds that exceed one hundred Mbps when supporting 5G technology.

A quickening ROI for carriers?

ROI-focused carriers are unlikely to use fiber to reach all unserved and underserved rural areas, opting for the quicker to deploy and less expensive FWA approach for home broadband.

Global carrier equipment maker Ericsson sees Fixed Wireless Access (FWA) as an efficient and scalable alternative to wired connections. "With smart and targeted deployments, our studies show that the investment typically pays off in less than two years." The vendor believes it can help its operator customers accelerate this in instances where 5G technology is used.

Over 75 percent of service providers now offer FWA. In October 2021, Ericsson, for the sixth time, updated its study of retail packages offered by service providers worldwide. Out of 312 service providers studied, 239 had an FWA offering, representing an average of 77 percent globally. Service providers’ adoption of FWA offerings has more than doubled in the last three years.

Looking ahead

How fixed wireless access is being offered: Ericsson survey says…Ericsson’s updated study of retail packages offered by service providers worldwide in October of last year provided important detail on how carriers structure FWA for their customers.

The majority (88 percent) of FWA offerings are best effort with a monthly volume tariff plan based on usage (GB/month), according to the survey. However, 12 percent of service providers respondents offer a QoS. Ericsson defines this as selling FWA services “with speed tiers, which it claims enables higher monetization, akin to how fiber-based broadband services are offered.”

Forty percent of these QoS offerings are basic, with average/typical speeds being advertised, the vendor added. "Some 60 percent are more advanced QoS offerings, involving speed tiers, such as 100Mbps, 300Mbps, and 500Mbps."

QoS in the U.S. Service providers with 5G fixed wireless access are more likely to have a QoS offering, with seventeen out of fifty-six utilizing this approach (30 percent), according to Ericsson global service provider survey. North America is the region with the highest adoption, with 40 percent of all offerings based on QoS.

FWA CPE prices fall, choices expand. It appears 5G FWA deployments are being driven by lower costs CPE, something Dell’Oro Group identified over a year ago. The cost for indoor 5G FWA CPE is expected to drop from $475 in 2020 to $180 by the end of 2023.

“The global demand for broadband service has resulted in an acceleration of interest among fixed and mobile operators alike to either expand their existing LTE or point-to-multipoint fixed wireless access (FWA) offerings or roll out early 5G FWA services to a growing base of current and potential subscribers,” explained Jeff Heynen, Vice President, Broadband Access and Home Networking at Dell’Oro Group, a market research and analysis firm.