Articles

Sample Articles from Bob Wallace.

Read More about Bob.

Avoid Buyer's Regret: Top Tips for Assessing Infrastructure Provider Health Before Purchases and Contract Extensions

- Details

- Published on 31 March 2024

(Credit: Michael Borgers / Alamy Stock Photo)

Avoid Buyer's Regret: Top Tips for Assessing Infrastructure Provider Health Before Purchases and Contract Extensions

With large enterprise infrastructure purchases for services, including SASE, SD-WAN, wireless, and more, on the line, the tech behind the services may be proven, but can the provider deliver? Is the provider having business problems? What can buyers do to avoid regret or devastating mistakes?

“Enterprises are going to have to prepare for a lot of vendor consolidation over the course of the next two years and then service provider consolidation through the end of the decade,” explained Jeff Heynen, VP of Broadband Access and Home Networking at Dell’Oro Group, a global market research and analysis firm. “Right now, because operators are cutting back on their spending, vendors are retrenching and looking to cut costs. Some are looking to shed parts of their business to focus on their core operations.”

A Provider Health Checklist

Here is a list of items to check to help determine how a potential tech partner is faring business-wise.

Strategic reviews: Rarely announced publicly, in favor of behind-the-scenes activity, these crucial undertakings often result in substantial changes in the way a service provider or vendor determines its product and staffing priorities. The results can lead to phasing out products and business units and result in several of the actions listed below.

Project cutbacks and selloffs: One major infrastructure player confirmed late last year that it was cutting back its fiber service deployment markedly and sold parts of its tech assets, including CDN customers, to a major player in the sector. It is best to know of these actions as soon as possible before they are announced publicly.

Layoffs: Staff reductions can also signal problems as these cost-cutting efforts are often justified as rightsizing. The goal here is to determine why they are needed. Is your provider outsourcing a potentially crucial function, such as service and support, to a third party or preparing to drop a product line? Layoffs are expected after a merger or acquisition to eliminate duplication of efforts. But how will they affect your business?

Push past the stated percentage of total staff being cut to other vital details, such as what areas will be drawn down. Do they include sales, service, support, marketing, product development, engineering, or management?

Finances: Try to keep pace with your vendor/provider’s financial health. This is also essential before greenlighting a big ticket and/or big project with a new partner. Check out the provider’s annual and quarterly numbers – with help from your internal financial experts. Total revenue is often the most touted number discussed, but CapEx and profit growth are more important. Wall Street financial analyst reports can help.

Inactivity: No news is not always good news. Look for news of new customer wins, product enhancements, and partnerships to explore new areas. Filling gaps in products/technologies is also good news. Contacts developed inside your providers can be a priceless resource, more so if they depart the company.<?

Ownership: Are any of the vendors or operators you are considering for a major tech advancement project owned/run by private equity (PE) firms? Many regional fiber operators saw large PE investments or purchases in 2023. Green is good, but be aware that these firms typically acquire firms, boost the high performing assets, and shed much or all of underperforming or struggling assets before a sale. A transition can be rocky and usually includes a change of senior management.

Timing: Do any of the providers you are considering have incidences or a history of delivering products and services late/missing deadlines or TBD? The tech trade press tries to keep track of promised delivery and actual shipment. One Massachusetts business was excited to receive the newest networking gear from a prominent vendor until the boxes arrived empty.

Market research and analysis: These firms track industry sectors, subsectors, and vendors from startups to near duopolies on an ongoing, quarterly, or annual basis. Some rank players by leaders using business performance and often know vendors better than businesses looking for a solution provider. These firms also identify buying and tech trends (in the U.S. and internationally) that can be invaluable for your pre-purchase.

Vertical industry groups and associations: These organizations and their associated events provide an opportunity to meet with other companies that face business and tech challenges similar to your company's. Attendees often discuss the experiences of vendors and operators they have done business with or plan to. The takes of other users and this environment can be more useful than vendor-held annual gatherings as they are more focused, covering the IT and business needs - and more independent.

A Final Word on Picking an Infrastructure Provider

Learn which signs of provider health to be concerned about before making a commitment to a potential long-term partner to help your enterprise change the way it does business for years to come. Missing signals could result in a decision you may later regret.

Related articles:

What is Network-as-a-Service (NaaS)? A Complete Guide

- Details

- Published on 18 March 2024

(Credit: JL / Alamy Stock Photo)

Network-as-a-Service (NaaS) offers a flexible, cost-effective, and efficient way for businesses to manage their networking needs. Here is an overview to guide your selection and use of NaaS.

Network-as-a-Service (NaaS) is much more than an emerging subscription model for corporate networks.

With NaaS, the provider is responsible for buying and managing the routers, switches, load balancers, firewalls, and other security devices that once made up the infrastructure of costly, resource-draining, and limited-flexibility private networks.

What Preceded NaaS?

For decades, the traditional solution for wide-area networks has been private networks whereby enterprises bought, managed, and maintained networking equipment and secured connections serving onsite data centers. That practice was eclipsed by the more flexible and cost-efficient cloud architecture.

Then came Network-as-a-Service (NaaS), an emerging option intended to be provided across a standards-based automated ecosystem to help organizations meet fluctuating data needs and achieve business goals.

Soaring data traffic, driven by the broadening use of 5G, IoT, and video streaming (and the rapid emergence of AI), has given rise to the newer and more flexible WAN approach. Beyond not buying, managing, or maintaining network equipment, bandwidth, and specialized talent, NaaS offers many capabilities and functionality.

How Network as a Service Works

The MEF, an industry association and advocate for NaaS and friends, describes a full-bodied offering as "a new-paradigm solution by combining on-demand connectivity, application assurance, cybersecurity, and multi-cloud-based services delivered across a standards-based automated ecosystem of partners."

Of great importance is the MEF’s development of a much-needed NaaS Industry Blueprint and its work on open APIs. Network-as-a-Service providers need these APIs to automate common functions like order processing, service provisioning, and security. They can make it easier for an enterprise to order and use NaaS services.

Read more: What is Network-as-a-Service (NaaS)? A Complete Guide

How Undersea Cable Cuts are Making Global Business Increasingly Risky

- Details

- Published on 18 March 2024

(Credit: Wilf Doyle / Alamy Stock Photo)

With no viable alternatives, governments, enterprises, and operators team to tackle longstanding undersea cable resiliency challenges.

Is network resiliency able to reach beyond five nines and SLAs for enterprises seeking always-on services?

Given recent headlines and discussion in the wake of undersea cable cuts in the Red Sea, the answer is still no for multinationals. The situation is best described as business interruption as usual.

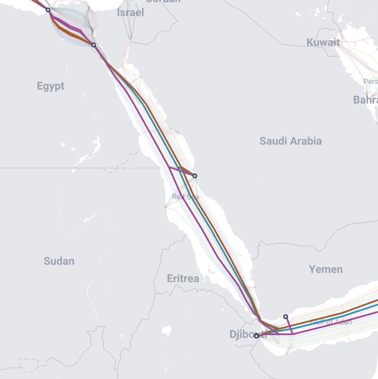

On Saturday, February 24, three different cables were reported to have suffered faults:

These international systems connect far-apart states like South Africa, the United Kingdom, and China. The faults off the coast of Yemen need to be repaired. The work is tough to do in a narrow, heavily traveled shipping lane that doubles as a war zone with a concentration of submarine cables on the sea floor.

Fighting in the Middle East is a concern as enterprises and the telecom industry rely on undersea cables to carry the bulk of their intercontinental traffic.

Since late February, three more faults in the region have been reported, according to TeleGeography, a research firm that builds and maintains massive data sets that are used to monitor, forecast, and map the telecommunications industry. One report has a ship dragging an anchor as the culprit, which the firm claims is the second most frequent cause behind cuts/faults of these business and communications lifelines.

Three cables with faults in the Red Sea from TeleGeography's Submarine Cable Map. Note: The cable map illustrates the topology of cables but does not show the physical path.

The cause of the undersea cable disruption is still uncertain

Whodunnit? Since then, no open-source evidence has come out to support the claim that Houthis, part of a Yemen civil war, were responsible. "But here's one thing we do know: accidents happen all the time," noted Tim Stronge, Research VP at TeleGeography, in a March 5 advisory. "On average, two cables suffer faults somewhere in the world every week!”

The research firm tracks 574 active and planned submarine cables as of early 2024.

Suspicious activity or not?

Stronge does not believe the three almost simultaneous cable faults are overly suspicious.

“Geological features or permitting issues have occasionally forced installers to lay different cables in close proximity to each other,” he explained. Such a situation increases the danger of a multi-cable fault.

In 2012, multiple cables suffered faults off the coast of Alexandria, Egypt. “Initial speculation blamed saboteurs, but many in the submarine cable industry now believe that a single ship dragging its anchor was the cause.”

Is it time to panic?

Although the Red Sea cables carry 90% of Europe-Asia communications flow through them, operators have built a lot of redundancy into the network. The ability to reroute traffic is increasingly available.

There are fourteen cables already laid on the Red Sea. Even if three are down, eleven remain, wrote Stronge. “Data destined for damaged cables may be rerouted southward around the Cape of Good Hope or eastward through Asia and the United States.”

Tougher times ahead for undersea cable industry

Houthi attacks on ships make life tougher for the undersea cable industry, which could hurt enterprises.

- Vessels that are sinking or sunken present new underwater hazards to cables and cable ships. The cables typically lie on the ocean floor.

- Shipping attacks have caused marine insurance rates to spike.

- Combined, these two may make the installation of new cables in the Red Sea too prohibitive and make repair risky.

Items for governments to act on

Governments are the ones on the hook for the long-term security of subsea cables. The International Cable Protection Committee (ICPC) has created a list of 16 action items.

ICPC membership comprises governmental administrations and commercial companies that own or operate submarine telecommunications or power cables, as well as other companies that have an interest in the submarine cable industry—including most of the world’s major cable system owners and cable ship operators. The group says the primary purpose of the ICPC is to help its members improve the security of undersea cables by providing a forum in which relevant technical, legal, and environmental information can be exchanged. U.S. members include JP Morgan Chase, Wells Fargo, University of Hawaii, U.S. Navy, Johns Hopkins University, AT&T and Ciena.

One priority, which is a work in progress, is changing rules and regulations to open new seabed lanes and landing zones for cables. Having physically diverse zones provides options in locating where cables come ashore.

Flirting with disaster

“Some government regulations (such as environmental protection) may unintentionally herd cables into narrow corridors,” explained Stronge. “As we’ve seen time and time again, a lack of physical diversity invites disaster.”

Seeking alternatives

When it comes to alternatives to undersea cables, the cupboard is bare. Satellite connections are not fast or large enough to carry the traffic load on submarine pipes. 5G is not mature enough to help.

One approach is to install cables over alternative routes. As we reported in December, the SeaMeWe-6 cable project seeks to construct a cable that links Asia, the Middle East, and Europe via a route through India rather than the Red Sea. The article noted that the U.S. “snatched away” control of the project from China due to the importance of having alternative paths to send data.

Related articles:

Why Businesses Should Watch Wi-Fi-7 Closely

- Details

- Published on 18 March 2024

(Credit: Denys Rudyi / Alamy Stock Photo)

Industry experts predict a rapid emergence for the latest Wi-Fi version. Streaming and dense device use cases are seen as fits.

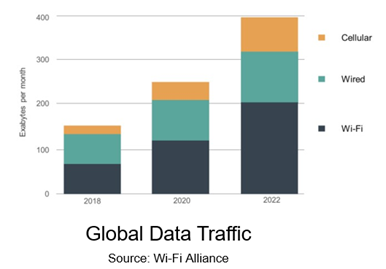

With wireless traffic far exceeding wireline data, it seems like a safe bet that the emergence of Wi-Fi 7 will take and hold the attention of enterprises and carriers looking to put the latest Wi-Fi products to work.

Buoyed by the recently launched Wi-Fi 7 Certified product certification program by the Wi-Fi Alliance, approved products will likely be embraced as part of the most compelling segment of the Internet access market this year.

“With the Wi-Fi Alliance recently announcing the opening of certification testing for Wi-Fi 7 products, don’t be surprised to see dozens of Wi-Fi 7 residential routers and broadband CPE models being deployed by operators by the end of this year,” explained Jeff Heynen, VP Broadband Access and Home Networking at Dell’Oro Group, a global market research firm. "Early gateway models, though pricey, have already been introduced to the market and will become much more widely available this spring and then well before the holiday season."

Why the rise of Wi-Fi 7?

Wi-Fi 7 products offer significantly more performance for enterprise users and can support more users in denser environments compared to Wi-Fi 6. It is pitched as a match for streaming applications and is able to handle more users per Access Point (AP), which translates into fewer devices to manage and maintain in deployments.

Wi-Fi 7 is attractive for many reasons. The first is its flexibility. The IEEE standard 802.11be works with several radio frequency bands, including 2.4GHz, 5GHz, and 6GHz. Its speed is another selling point, as it provides links at up to 40,000 M bit/sec. "When using Wi-Fi 7, the quality and resolution of video streaming are improved by 16 spatial streams and Multiple Input Multiple Output (MIMO) technology," according to Mordor Intelligence. Another feature of Wi-Fi 7, Hybrid Automatic Repeat Request (HARQ), enables multiple link adaptation.

Also of importance is that WI-Fi-7 devices are compatible with its most recent predecessor, Wi-Fi 6E.

Operators to Embrace Wi-Fi 7

There is more to Wi-Fi 7’s rapid emergence than simply technical features and advanced capabilities.

“Operators can’t wait to deploy Wi-Fi 7 products to help differentiate themselves in increasingly crowded broadband markets and to eliminate much of the confusion in the market with the coexistence of Wi-Fi 6 and Wi-Fi 6E,” explained Heynen.

While Wi-Fi 6E offers specific benefits over its Wi-Fi 6 predecessor, the latter has been implemented by entertainment and sports venue owners to best service fans in the stands who are increasingly armed with powerful mobile devices equipped with team and concessions apps. Pro sports teams are using Wi-Fi 6 to collect data from fans, which is used to provide each attendee with a more personalized experience.

Higher Performance Wi-Fi 7 Driven by Soaring Traffic

The amount of traffic being carried over Wi-Fi networks globally has roughly quadrupled in four years. In contrast, traffic over wired networks has only grown modestly during that same period, according to the Wi-Fi Alliance.

Early Wi-Fi 7 Products at Mobile World Congress

Last year saw chip, module, and device vendors, including Qualcomm, Broadcom, Intel, MediaTek, and CommScope, roll out products. Now, the Wi-Fi Alliance is forecasting more than 233 million Wi-Fi 7 devices to enter the market in 2024, growing to 2.1 billion devices by 2028.

Keysight Technologies plans to show its Wi-Fi 7 wireless connectivity test platform at the Mobile World Congress 2024 (MWC) in Barcelona later this month.

Wi-Fi 7 Certified Program to Drive Deployment

Just last month, the Wi-Fi Alliance launched the Wi-Fi 7 Certified program, which is designed to approve an interoperable device that provides a certain set of required capabilities. It is unclear if products released before certification will be compliant or adjusted to be compliant. As a resource for operators and business users (and those working from home), the alliance has created a product finder resource on its website where folks can type in a product name and maker to see if it’s certified.

The Bottom Line on Wi-Fi 7

Streaming-friendly features, frequency flexibility, and the bandwidth to address dense device environments portend to fuel the emergence of Wi-Fi 7. The Wi-Fi 7 market was valued at $875 million in the current year and is expected to reach $6.07 billion in the next five years, registering a CAGR of 47.32% over the forecast period, according to Mordor Intelligence.

The Wi-Fi 7 space is worth watching – closely - for enterprises and operators.

Related articles:

Satellite Operators Team to Pursue Direct-to-Device Opportunity

- Details

- Published on 22 February 2024

(Credit: colaimages / Alamy Stock Photo)

New mobile association seeks help developing integrated terrestrial and non-terrestrial network (NTN) services for smartphones and IoT devices worldwide.

A group of five prominent satellite operators has launched a new association to accelerate the emergence of direct-to-device (D2D) services for use by businesses and consumers.

Introduced on February 9, the Mobile Satellite Services Association’s founding members include ViaSat, Ligado Networks, Terrestar Solutions, Omnispace, and Al Yah Satellite Communications Company.

What they need to eventually succeed in building an open standards-based interoperable framework is the buy-in of mobile phone makers, chipset vendors, government groups, and mobile operators into the MSSA's planned ecosystem.

The MSSA’s charter members claim they bring to the table over one hundred megahertz of L- and S-band spectrum that has already been allocated and licensed for a range of services.

Coming Soon to Mobile World Congress 2024

The fledgling association will be attending the fast-approaching Mobile World Congress (MWC), a global mobile event, to recruit additional members, according to an MSSA spokesperson.

The MSSA has “a vision of integrating terrestrial and non-terrestrial network (NTN) services to deliver scalable, sustainable, and affordable connectivity to any device, anytime, anywhere.” That includes uniform chipsets that mobile handsets, IoT modules, and more devices can use to operate anywhere in the world despite what countries currently have for cellular services. “Once a user loses a cell signal, the handsets will switch over to the satellite connection,” explained Jacques LeDuc, Founding Member and Treasurer of the MSSA. He is also CEO of Terrestar Solutions, a Canadian satellite operator serving the country’s vast land mass that lacks cellular service.

Sought-after MSSA services would include non-proprietary offerings, which could serve as much-needed redundancy for businesses operating in areas with suboptimal cell service. Being able to use a set of interoperable services globally would also enable the long-term goal of mobile subscribers to roam the world, explained LeDuc.

“MSSA is trying to prevent fragmentation in the standards and promote interoperability for Direct-to-Device (D2D) satellite communications,” said Dave Bolan, Research Director at the Dell’Oro Group, a global technology market research firm. “Currently, MNOs and/or device manufacturers are enabling D2D satellite communications individually with different satellite service providers. They may or may not be following 3GPP standards with different signaling standards, he cautioned. “The MSSA believes to scale D2D satellite communications, interoperability is key, which they are promoting.”

The D2D NTN method allows a smartphone or an IoT device to connect directly to a satellite without an intermediate gateway when the device is out of range of an MNO's coverage area. To date, it has been focused on SMS messaging, explained Bolan.

The MSSA Take

"The MSSA is a game-changer for businesses, offering unparalleled connectivity that spans critical sectors like cellular, industrial, government, agriculture, maritime, automotive, and emergency services," said LeDuc. It's more than an association; it's about stepping into a future where everyone and every business, no matter the size, benefits from the advancements made by current mobile satellite license holders. This connectivity is key to smoother operations and enhanced safety for all."

The non-profit MSSA claims it intends to align with the 3rd Generation Partnership Project (3GPP) standards to extend terrestrial mobile coverage for both Mobile Network Operator (MNO) and Over-the-Top (OTT) internet services. It also plans to work with the GSMA to reach its goal of device interoperability.

The Race is On

The Deloitte Center for Technology, Media & Telecommunications (TMT), discussed the market in its TMT 2024 Outlook.

There is a race to build a new set of satellite-enabled global telecommunications services for consumers, enterprises, and governments. Basic services for emergency communication, text messages, and IoT monitoring have already started.

"To help make this a reality, capital is being raised, satellites are being launched, chips have been developed, regulatory frameworks established, and agreements with mobile network operators are being secured," the Deloitte analysts wrote. "Some are very bullish on the potential size of the market (reaching tens of billions of dollars in the next ten years), while others are expecting it to take a long time to mature and generate sufficient revenue."

In either case, they concluded, "this could represent an opportunity to significantly increase the size of the global satellite communications market."

What about the other satellite-to-cell phone efforts?

MSSA has launched and faces ongoing competition from satellite-to-phone services from the likes of Lynk Global, AST Space Mobile, T-Mobile and SpaceX, and Apple-Globalstar. These players see the use of cellular spectrum from their MNO alliances to quickly build a large customer base.

Two critical questions for Enterprise IT are:

What is the timing for satellite-to-cellphone services? SpaceX-owned Starlink claimed its satellite-to-cellphone (NTN) service will launch in 2024. The Musk-owned company said in mid-October it will first offer SMS, followed by voice and data services, and IoT connectivity in 2025.

Will the latest developments accelerate the availability of satellite services? What remains to be seen is how quickly emerging satellite services can expand and gain broad acceptance from businesses, financiers, regulators, and countries around the globe.

Related articles:

- 5 Challenges for Enterprises Considering LEO Satellite Services

- The Bottom Line on Upcoming Non-Terrestrial Network (NTN) Services

- Avoid Business Disruption in Times of Turmoil Here and Abroad

5G RedCap Promises Nirvana for IoT Deployments Globally. But Can it Deliver?

- Details

- Published on 15 February 2024

(Credit: Zoonar GmbH / Alamy Stock Photo)

Keeping IT’s attention as 5G Reduced Capacity (RedCap) services emerge will require rising above competitive solutions.

5G Reduced Capacity (RedCap) has the potential to fuel digital transformation by enabling IoT devices and use cases worldwide, but the specification is still in the early stage of proving its promise.

Last year saw limited progress as Qualcomm and Ericsson announced a few RedCap devices. Several telcos (Verizon with Nokia and MediaTek) announced tests of the early infrastructure offerings.

But the fledgling RedCap ecosystem needs to do more than marketing to convert its potential into progress, say wireless industry experts. “Are we adjusting mobile infrastructure revenues upward to accommodate stronger than expected data traffic growth as a result of an onslaught of RedCap devices?” asked Stefan Pongratz, Vice President for RAN and Telecom Capex research, at Dell’Oro Group, a global market research and analysis firm. “The answer is no. But we are monitoring the situation and expect to see some traction over the next couple of years.”

In teams of near-term developments, Pongratz expects commercial devices in 2024 and early adopters to kick the tires.

RedCap Recap

5G RedCap was created to add value and revenue to 5G implementations by enterprises and telcos by extending the standard down to a sea of IoT devices seeking higher speeds and lower latency than current solutions.

5G RedCap delivers throughputs of 150 and 50 Mbps in the downlink and uplink, respectively. This is far below 5G's support for gigabits of throughput but still well above the capabilities of current NB-IoT (downlink of 26 Kbps and an uplink of 62 Kbps) and eMTC (Cat-M1) offerings, which support a downlink of 58 Kbps and an uplink of 1.1 Mbps).

Creators hope RedCap means broader applicability for 5G and thus drives its emergence forward, in part by serving a broader array of use cases in industry and enterprise verticals and consumer applications.

"One of the primary aims is the full integration of IoT into 5G networks is to benefit from overall system technologies such as service-based architecture, network slicing, and the flexible air interface capabilities of standalone (SA) 5G," explained Kester Mann, at CCS Insight, a market research firm in the U.K.

This would enable telecom operators to offer custom services to enterprises and perhaps consumers.

But since it’s early on, Ericsson, which makes equipment for operators worldwide, has identified these use cases as a possible match for 5G RedCap. For consumers:

- Smartwatch/wearable – longer battery life with richer functionality.

- AR/VR – slim form factor AR glasses for shopping, sightseeing, mid-range multimedia, service applications, information, and education.

For industry:

- Video monitoring – keep an eye on your entire facility using cameras and sensors.

- Smart manufacturing – connecting every part of the process.

- Inventory management – register your stock, move it around, and change its status when sold or delivered.

RedCap Challenges

Beyond video? While many use cases can benefit from the high-speed and low latency features of 5G and 5G RedCap, especially those supporting video delivery, attracting enterprises using LPWA networks or those using much less than 5G, such as 4G wireless, seems to be a tall task.

Sunsets drive 5G day breaks. That's the case for all the enterprises in the U.S. and abroad who have migrated their networks to 4G as operators in their countries have sunsetted slower and older 2G and 3G networks to use the spectrum and other resources for 5G rollouts.

Low-speed networks continue. Those still using tried and true LPWA networks have done so because they employ low cost, long battery life modules. The devices transmit often sporadic data that works well with low-speed connections.

Luring manufacturers to 5G RedCap for part or all of their building processes to Industrial Internet of Things (IIoT) seems like a bridge too far for years to come.

Spending slowdowns. The second half of last year saw a slowdown in telecom spending, vendors slashing staff, consolidation leading some to drop product lines, and more. For RedCap to evolve to fill a pitched gap between current solutions and full-bore 5G speed, low latency, and features, spending on 5G infrastructure and IoT tech needs to head upward. That’s a tall task in uncertain markets.

Related articles: