Articles

Sample Articles from Bob Wallace.

Read More about Bob.

Fixed Wireless Access Benefits Extend to Enterprises

- Details

- Published on 15 May 2024

(Credit: Tadej Pibernik / Alamy Stock Photo)

Pending 6GHz spectrum availability, faster speeds, and private wireless access use drive FWA forward.

Fixed wireless access has lived in the shadow of fiber in the nationwide broadband breakout. But now, higher speed, expanded use cases, and the anticipated availability of 6GHz spectrum have the option of commanding a broader role, which includes corporate networking.

"Fixed Wireless Access has proven that it can provide connectivity both in rural and underserved markets while also competing head-to-head with fixed broadband technologies in urban and suburban markets," said Jeff Heynen, Vice President and analyst with the Dell’Oro Group . “Beyond residential connectivity, enterprises are relying more heavily on FWA-enabled routers and gateways to connect branch offices, vehicles, and kiosks as part of their own private wireless initiatives,” added Heynen.

Beyond residential use

Fixed Wireless Access (FWA) has surged in recent years to support both residential and enterprise connectivity due to its ease of deployment along with the more widespread availability of 4G LTE and 5G Sub-6GHz networks, which offer increased throughput and reliability, comparable in many cases to more traditional fixed broadband technologies.

The most important trend, according to one analyst, has been the increase in millimeter wave deployments at Verizon and USCellular. “Both are planning to use mmWave in urban areas where subscribers are close to small cells. mmWave can deliver speeds beyond 1Gbps and is averaging speeds of anywhere from 300-1.5Gbps, depending on the distance to the small cell,'" explained Heynen.

T-Mobile is also discussing using mmWave to complement its mid-band spectrum-based FWA offerings. "That market and technology are going to see interesting developments and use cases throughout the year and into next year," predicted Heynen.

When used for 5G signals, millimeter waves (mmWaves) are produced using low-power small cells. These small cells are arranged as a network in clusters to provide coverage in an area. This band of frequencies provides greater bandwidth, making it ideal for network operators to provide faster service to bandwidth-intensive applications.

6GHz for FWA

Another watershed development in the emergence of FWA would be the opening of spectrum in the 6GHz band for the use of unlicensed FWA. However, before this work-in-progress becomes a reality, companies that must be found to operate advanced frequency control (AFC) systems to guard against interference must complete testing tasks and receive approval from the FCC.

At last check, the agency cleared seven vendors to test their AFCs. They include:

- Broadcom

- Comsearch

- Federated Wireless

- Qualcomm

- Sony

- Wi-Fi Alliance

- Wireless Broadband Alliance

At least six more entities have received conditional FCC approval.

The North American market remains the most dynamic in terms of deployed FWA technology options, with CBRS and other sub-6GHz options growing alongside 5G NR and 60 GHz options.

5G FWA technology is seen as an accelerator, and its use is expected to represent 45% of the total FWA subscription base by 2029, reaching 118 million at a CAGR of 35%, according to a report from ABI Research.

FWA Benefits and Challenges

The top benefits of FWA are that it can be deployed without cable in the ground or hung on poles and requires only limited permitting. And with access to additional spectrum, it's easier to find space for wireless communications. As a result, FWA is quicker to deploy, cheaper, and more flexible than fiber, especially in mountainous and wooded terrain.

The biggest challenge remaining is that FWA requires a clear line of sight between the point of signal original and the points of the requested termination. A longstanding shortcoming of FWA is its lower than fiber data speeds supported in resulting services. However, the ability to use additional spectrum has some service providers talking speeds of up to 1 Gigabit/sec.

Challenging terrain deployments can be made more accurate and quicker using Light Detection and Ranging (LiDAR), which uses light and sensors to help survey and mapping. The tech creates accurate maps and digital elevation models for geographic information systems for commercial surveying and mapping applications.

A final thought on FWA

The fiber first and foremost focus that came with the BEAD program didn’t seem to leave room in the broadband breakout for other access options. Now, years later, the realities of closing the digital divide and the near-term needs of users have created plenty of room for FWA.

In fact, The FWA equipment spend is expected to exceed $40 billion over the next five years, according to Dell’Oro Group. Spending on 4G and 5G-enabled enterprise routers and gateways is expected to reach $4 billion by 2027.

SASE Architecture: A Checklist for SASE-savvy Businesses

- Details

- Published on 31 March 2024

(Credit: Liubomir Paut-Fluerasu / Alamy Stock Photo)

SASE can provide secure and efficient access to cloud-based services and resources for users, regardless of their location. Follow this checklist to attain this goal.

Secure access service edge (SASE) provides companies a centralized means to manage, monitor, and optimize their wide-area networks, SASE solutions provide the flexibility to protect corporate assets, remote offices, and home-based and mobile employees, as security threats continue to evolve and rapidly increase.

Introduction to SASE Architecture

SASE is an architecture that provides converged network and security as a service with an array of cloud-based capabilities that can be located where and used when they are needed.

As such, SASE expands the perimeter to include all resources, regardless of their location or device. It provides a single and consistent security policy spanning all network and application assets.

Read more: SASE Architecture: A Checklist for SASE-savvy Businesses

Akamai to Deploy Advanced AI Across its Global Edge Network

- Details

- Published on 31 March 2024

(Credit: Denis Putilov / Alamy Stock Photo)

With partner Neural Magic's software, potential user benefits may include lower latency, higher service levels, and faster response times.

Cloud and content delivery network Akamai Technologies last week teamed with Neural Magic to deploy advanced artificial intelligence (AI) software across its global edge server network.

The duo's efforts could provide businesses with lower latency, higher service levels, and faster response times. Adding the software could enable use cases such as AI inference, immersive retail, and spatial computing.

Long ago, Akamai built a distributed global network comprised of edge servers containing cached content located close to users to cut the time and boost the performance of delivering rich media such as streaming video. Now, the provider is using the same network to provide Neural Magic's AI much closer to the sources of user data.

The company said it intends to “supercharge” its deep learning capabilities by leveraging Neural Magic’s software, which enables AI workloads to be run more efficiently on traditional central processing unit-based servers, as opposed to more advanced hardware powered by graphics processing units (GPUs).

Potential Business Benefits of AI at the Edge

One expert sees several potential benefits to using Akamai’s content delivery network (CDN) business customers with Neural Magic’s AI acceleration software.

“This could potentially lower the cost of service and still meet the requirements for the AI workloads,” said Baron Fung, Senior Research Director at Dell’Oro Group, a global telecom market research and consulting firm. “Lower cost can be achieved because the service provider (Akamai) can use general-purpose servers that uses traditional infrastructure, rather than expensive dedicated AI/GPU servers and infrastructure.”

Potential applications benefits are possible "because these nodes are situated at the network edge, close to where the user or machines are located, faster response time of applications for customers could be realized, especially for workloads that are AI related."

Higher service levels could be attained. “Because of the scalable nature of the solution, new CDN nodes suitable for AI workloads could be scaled quickly in high-demand regions.”

Running AI Workloads Close to Data Sources

In February, Akamai launched its Generalized Edge Compute (GECKO) initiative which focused on embedding cloud computing capabilities in the provider’s massive edge network. The initiative will efficiently support modern applications and workloads, wrote Zacks Investment Research. “These workloads will span a wide range of next generation use cases such as AI inference, immersive retail, and spatial computing.”

Related articles:

Avoid Buyer's Regret: Top Tips for Assessing Infrastructure Provider Health Before Purchases and Contract Extensions

- Details

- Published on 31 March 2024

(Credit: Michael Borgers / Alamy Stock Photo)

Avoid Buyer's Regret: Top Tips for Assessing Infrastructure Provider Health Before Purchases and Contract Extensions

With large enterprise infrastructure purchases for services, including SASE, SD-WAN, wireless, and more, on the line, the tech behind the services may be proven, but can the provider deliver? Is the provider having business problems? What can buyers do to avoid regret or devastating mistakes?

“Enterprises are going to have to prepare for a lot of vendor consolidation over the course of the next two years and then service provider consolidation through the end of the decade,” explained Jeff Heynen, VP of Broadband Access and Home Networking at Dell’Oro Group, a global market research and analysis firm. “Right now, because operators are cutting back on their spending, vendors are retrenching and looking to cut costs. Some are looking to shed parts of their business to focus on their core operations.”

A Provider Health Checklist

Here is a list of items to check to help determine how a potential tech partner is faring business-wise.

Strategic reviews: Rarely announced publicly, in favor of behind-the-scenes activity, these crucial undertakings often result in substantial changes in the way a service provider or vendor determines its product and staffing priorities. The results can lead to phasing out products and business units and result in several of the actions listed below.

Project cutbacks and selloffs: One major infrastructure player confirmed late last year that it was cutting back its fiber service deployment markedly and sold parts of its tech assets, including CDN customers, to a major player in the sector. It is best to know of these actions as soon as possible before they are announced publicly.

Layoffs: Staff reductions can also signal problems as these cost-cutting efforts are often justified as rightsizing. The goal here is to determine why they are needed. Is your provider outsourcing a potentially crucial function, such as service and support, to a third party or preparing to drop a product line? Layoffs are expected after a merger or acquisition to eliminate duplication of efforts. But how will they affect your business?

Push past the stated percentage of total staff being cut to other vital details, such as what areas will be drawn down. Do they include sales, service, support, marketing, product development, engineering, or management?

Finances: Try to keep pace with your vendor/provider’s financial health. This is also essential before greenlighting a big ticket and/or big project with a new partner. Check out the provider’s annual and quarterly numbers – with help from your internal financial experts. Total revenue is often the most touted number discussed, but CapEx and profit growth are more important. Wall Street financial analyst reports can help.

Inactivity: No news is not always good news. Look for news of new customer wins, product enhancements, and partnerships to explore new areas. Filling gaps in products/technologies is also good news. Contacts developed inside your providers can be a priceless resource, more so if they depart the company.<?

Ownership: Are any of the vendors or operators you are considering for a major tech advancement project owned/run by private equity (PE) firms? Many regional fiber operators saw large PE investments or purchases in 2023. Green is good, but be aware that these firms typically acquire firms, boost the high performing assets, and shed much or all of underperforming or struggling assets before a sale. A transition can be rocky and usually includes a change of senior management.

Timing: Do any of the providers you are considering have incidences or a history of delivering products and services late/missing deadlines or TBD? The tech trade press tries to keep track of promised delivery and actual shipment. One Massachusetts business was excited to receive the newest networking gear from a prominent vendor until the boxes arrived empty.

Market research and analysis: These firms track industry sectors, subsectors, and vendors from startups to near duopolies on an ongoing, quarterly, or annual basis. Some rank players by leaders using business performance and often know vendors better than businesses looking for a solution provider. These firms also identify buying and tech trends (in the U.S. and internationally) that can be invaluable for your pre-purchase.

Vertical industry groups and associations: These organizations and their associated events provide an opportunity to meet with other companies that face business and tech challenges similar to your company's. Attendees often discuss the experiences of vendors and operators they have done business with or plan to. The takes of other users and this environment can be more useful than vendor-held annual gatherings as they are more focused, covering the IT and business needs - and more independent.

A Final Word on Picking an Infrastructure Provider

Learn which signs of provider health to be concerned about before making a commitment to a potential long-term partner to help your enterprise change the way it does business for years to come. Missing signals could result in a decision you may later regret.

Related articles:

What is Network-as-a-Service (NaaS)? A Complete Guide

- Details

- Published on 18 March 2024

(Credit: JL / Alamy Stock Photo)

Network-as-a-Service (NaaS) offers a flexible, cost-effective, and efficient way for businesses to manage their networking needs. Here is an overview to guide your selection and use of NaaS.

Network-as-a-Service (NaaS) is much more than an emerging subscription model for corporate networks.

With NaaS, the provider is responsible for buying and managing the routers, switches, load balancers, firewalls, and other security devices that once made up the infrastructure of costly, resource-draining, and limited-flexibility private networks.

What Preceded NaaS?

For decades, the traditional solution for wide-area networks has been private networks whereby enterprises bought, managed, and maintained networking equipment and secured connections serving onsite data centers. That practice was eclipsed by the more flexible and cost-efficient cloud architecture.

Then came Network-as-a-Service (NaaS), an emerging option intended to be provided across a standards-based automated ecosystem to help organizations meet fluctuating data needs and achieve business goals.

Soaring data traffic, driven by the broadening use of 5G, IoT, and video streaming (and the rapid emergence of AI), has given rise to the newer and more flexible WAN approach. Beyond not buying, managing, or maintaining network equipment, bandwidth, and specialized talent, NaaS offers many capabilities and functionality.

How Network as a Service Works

The MEF, an industry association and advocate for NaaS and friends, describes a full-bodied offering as "a new-paradigm solution by combining on-demand connectivity, application assurance, cybersecurity, and multi-cloud-based services delivered across a standards-based automated ecosystem of partners."

Of great importance is the MEF’s development of a much-needed NaaS Industry Blueprint and its work on open APIs. Network-as-a-Service providers need these APIs to automate common functions like order processing, service provisioning, and security. They can make it easier for an enterprise to order and use NaaS services.

Read more: What is Network-as-a-Service (NaaS)? A Complete Guide

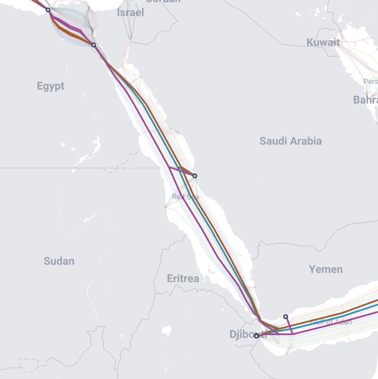

How Undersea Cable Cuts are Making Global Business Increasingly Risky

- Details

- Published on 18 March 2024

(Credit: Wilf Doyle / Alamy Stock Photo)

With no viable alternatives, governments, enterprises, and operators team to tackle longstanding undersea cable resiliency challenges.

Is network resiliency able to reach beyond five nines and SLAs for enterprises seeking always-on services?

Given recent headlines and discussion in the wake of undersea cable cuts in the Red Sea, the answer is still no for multinationals. The situation is best described as business interruption as usual.

On Saturday, February 24, three different cables were reported to have suffered faults:

These international systems connect far-apart states like South Africa, the United Kingdom, and China. The faults off the coast of Yemen need to be repaired. The work is tough to do in a narrow, heavily traveled shipping lane that doubles as a war zone with a concentration of submarine cables on the sea floor.

Fighting in the Middle East is a concern as enterprises and the telecom industry rely on undersea cables to carry the bulk of their intercontinental traffic.

Since late February, three more faults in the region have been reported, according to TeleGeography, a research firm that builds and maintains massive data sets that are used to monitor, forecast, and map the telecommunications industry. One report has a ship dragging an anchor as the culprit, which the firm claims is the second most frequent cause behind cuts/faults of these business and communications lifelines.

Three cables with faults in the Red Sea from TeleGeography's Submarine Cable Map. Note: The cable map illustrates the topology of cables but does not show the physical path.

The cause of the undersea cable disruption is still uncertain

Whodunnit? Since then, no open-source evidence has come out to support the claim that Houthis, part of a Yemen civil war, were responsible. "But here's one thing we do know: accidents happen all the time," noted Tim Stronge, Research VP at TeleGeography, in a March 5 advisory. "On average, two cables suffer faults somewhere in the world every week!”

The research firm tracks 574 active and planned submarine cables as of early 2024.

Suspicious activity or not?

Stronge does not believe the three almost simultaneous cable faults are overly suspicious.

“Geological features or permitting issues have occasionally forced installers to lay different cables in close proximity to each other,” he explained. Such a situation increases the danger of a multi-cable fault.

In 2012, multiple cables suffered faults off the coast of Alexandria, Egypt. “Initial speculation blamed saboteurs, but many in the submarine cable industry now believe that a single ship dragging its anchor was the cause.”

Is it time to panic?

Although the Red Sea cables carry 90% of Europe-Asia communications flow through them, operators have built a lot of redundancy into the network. The ability to reroute traffic is increasingly available.

There are fourteen cables already laid on the Red Sea. Even if three are down, eleven remain, wrote Stronge. “Data destined for damaged cables may be rerouted southward around the Cape of Good Hope or eastward through Asia and the United States.”

Tougher times ahead for undersea cable industry

Houthi attacks on ships make life tougher for the undersea cable industry, which could hurt enterprises.

- Vessels that are sinking or sunken present new underwater hazards to cables and cable ships. The cables typically lie on the ocean floor.

- Shipping attacks have caused marine insurance rates to spike.

- Combined, these two may make the installation of new cables in the Red Sea too prohibitive and make repair risky.

Items for governments to act on

Governments are the ones on the hook for the long-term security of subsea cables. The International Cable Protection Committee (ICPC) has created a list of 16 action items.

ICPC membership comprises governmental administrations and commercial companies that own or operate submarine telecommunications or power cables, as well as other companies that have an interest in the submarine cable industry—including most of the world’s major cable system owners and cable ship operators. The group says the primary purpose of the ICPC is to help its members improve the security of undersea cables by providing a forum in which relevant technical, legal, and environmental information can be exchanged. U.S. members include JP Morgan Chase, Wells Fargo, University of Hawaii, U.S. Navy, Johns Hopkins University, AT&T and Ciena.

One priority, which is a work in progress, is changing rules and regulations to open new seabed lanes and landing zones for cables. Having physically diverse zones provides options in locating where cables come ashore.

Flirting with disaster

“Some government regulations (such as environmental protection) may unintentionally herd cables into narrow corridors,” explained Stronge. “As we’ve seen time and time again, a lack of physical diversity invites disaster.”

Seeking alternatives

When it comes to alternatives to undersea cables, the cupboard is bare. Satellite connections are not fast or large enough to carry the traffic load on submarine pipes. 5G is not mature enough to help.

One approach is to install cables over alternative routes. As we reported in December, the SeaMeWe-6 cable project seeks to construct a cable that links Asia, the Middle East, and Europe via a route through India rather than the Red Sea. The article noted that the U.S. “snatched away” control of the project from China due to the importance of having alternative paths to send data.

Related articles: